Tax refund interest calculator

Additions to Tax and Interest Calculator. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

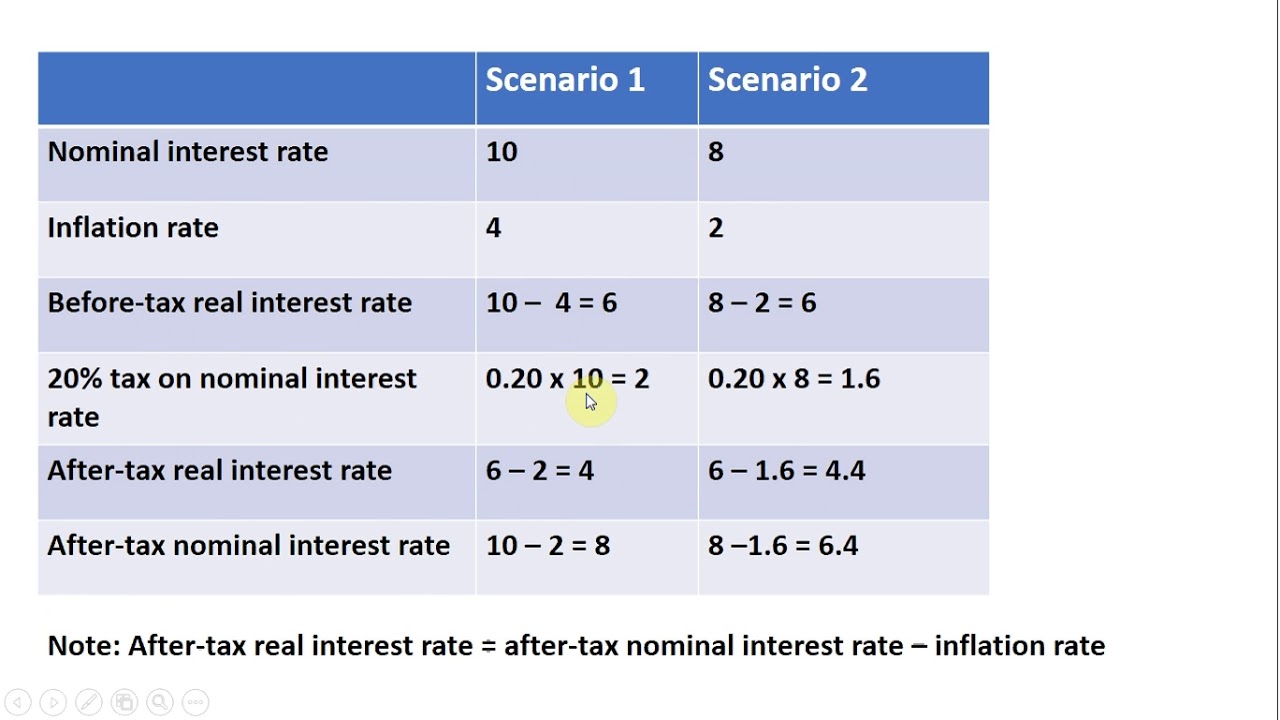

Calculating Before Tax And After Tax Real And Nominal Interest Rates Youtube

Youll fill out basic personal and family information to determine your filing status and claim any dependents.

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

. Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. IT Dept levied interest of 1 per month on interest on IT refund received under. The underpayment interest applies even if you file.

The IRS charges underpayment interest when you dont pay your tax penalties additions to tax or interest by the due date. Taxpayers receive interest on refunds from Income Tax Department after the processing of their returns is complete. The above calculator provides for interest calculation as per Income-tax Act.

Youll fill out basic personal and family information to determine your filing status and claim any dependents. Up to 10 cash back Our tax refund calculator will do the work for you. This IRS penalty and interest.

Free Federal Tax Calculator. IRC 6621 Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar quarter plus. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for.

The interest calculation is initialized with the amount due of. Up to 10 cash back Our tax refund calculator will do the work for you. The rate of interest on refunds arising due to excess.

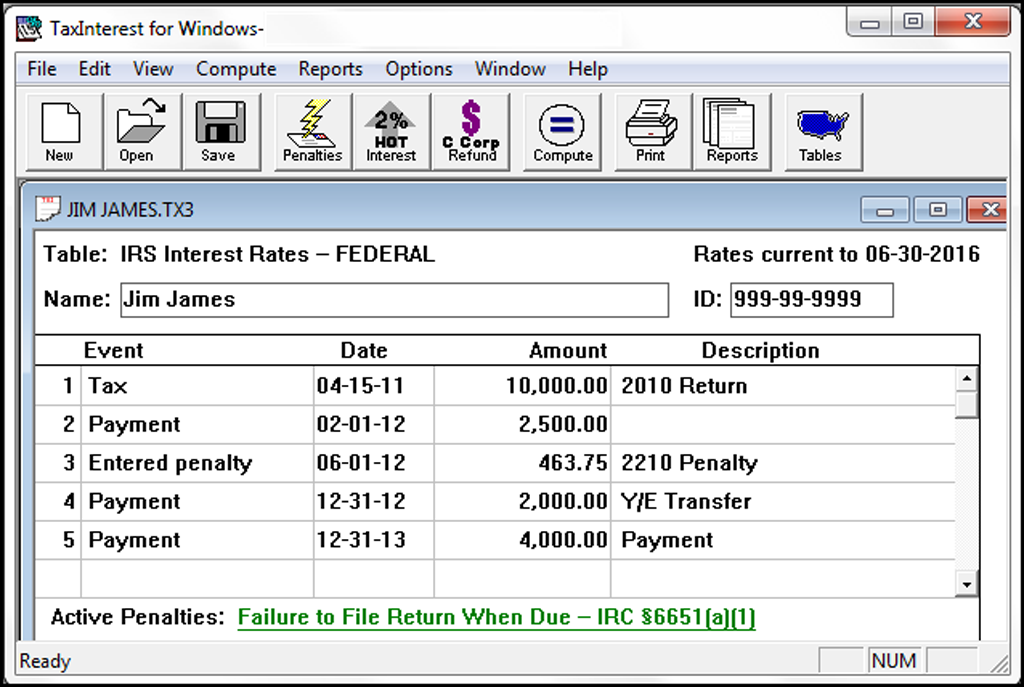

IRS Interest Rates Table Explain this calculation Individual. Interest Balance The amount due from which gathered interest until has compounded to. For married taxpayers filing separate returns the cap is.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Where the refund is paid out of any tax paid under sec 140A self assessment tax such interest shall be calculated at rate of 050 percent per month or part of a month from the. Income Tax refund 100 cr received with interest 20 cr in March 2017 pertaining earlier years.

Trial calculations for tax owed per return over 750 and under 20000. Upgrade to two years for 90. Changes to the rate dont.

Wages from a job interest earned Social. How We Calculate Interest Rates We use the federal short-term rate based on daily compounding interest to calculate the interest we charge and pay.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

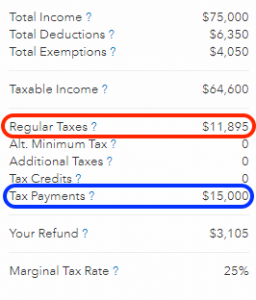

Simple Tax Refund Calculator Or Determine If You Ll Owe

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Calculator Estimate Your Income Tax For 2022 Free

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax Day 2019 H R Block S Tax Calculator Estimates 2018 Tax Refund

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax